Fintech industry is an alluring one. You probably know it, but we’ll show you numbers that will attract you even more. While it is competitive, there are endless opportunities here, and developing a finance app can be a good option. For that, however, you need to check the industry, explore its numerous segments, and choose the field where you’ll be the most comfortable. Then, you can learn it and start there.

Check the finance app development service for further information. Here, let’s overview the fintech market and how apps solve people’s resource-related issues in various ways. The ultimate aim is to make their life happier and more aware. Then, estimate the development costs and show which features you can add to make your app better than others.

Short intro to the fintech industry.

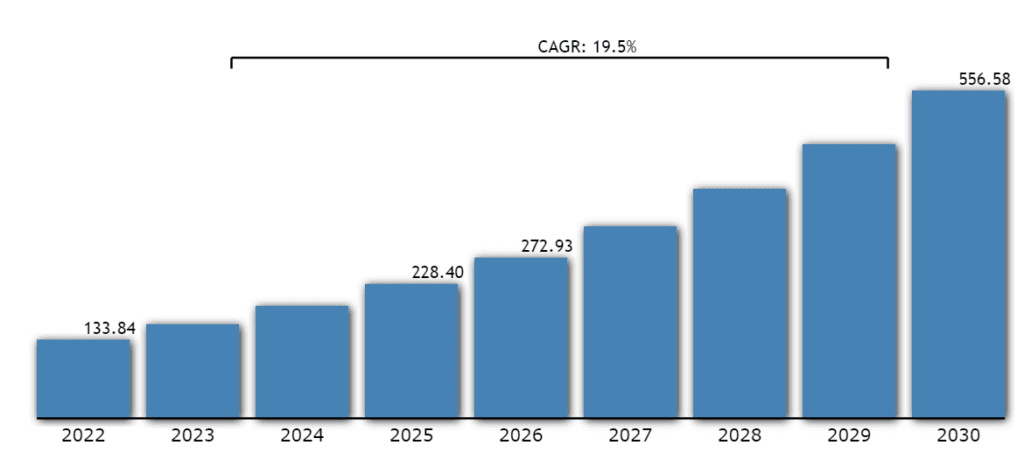

Let’s explore the industry numbers: this is the first step to entering and conquering it.

The industry’s estimated value is more than $130 billion. Researchers predict fourfold growth by 2030, so you have a large chance to jump into this wave!

In addition, in the first 4 months of 2022, there were almost 1,75 billion fintech app downloads around the world. The demand is high, and let’s now dive into its structure and see what you can find there. Which types are present, how do people use them, and which features you can add to make your app tasty?

Finance apps essentials

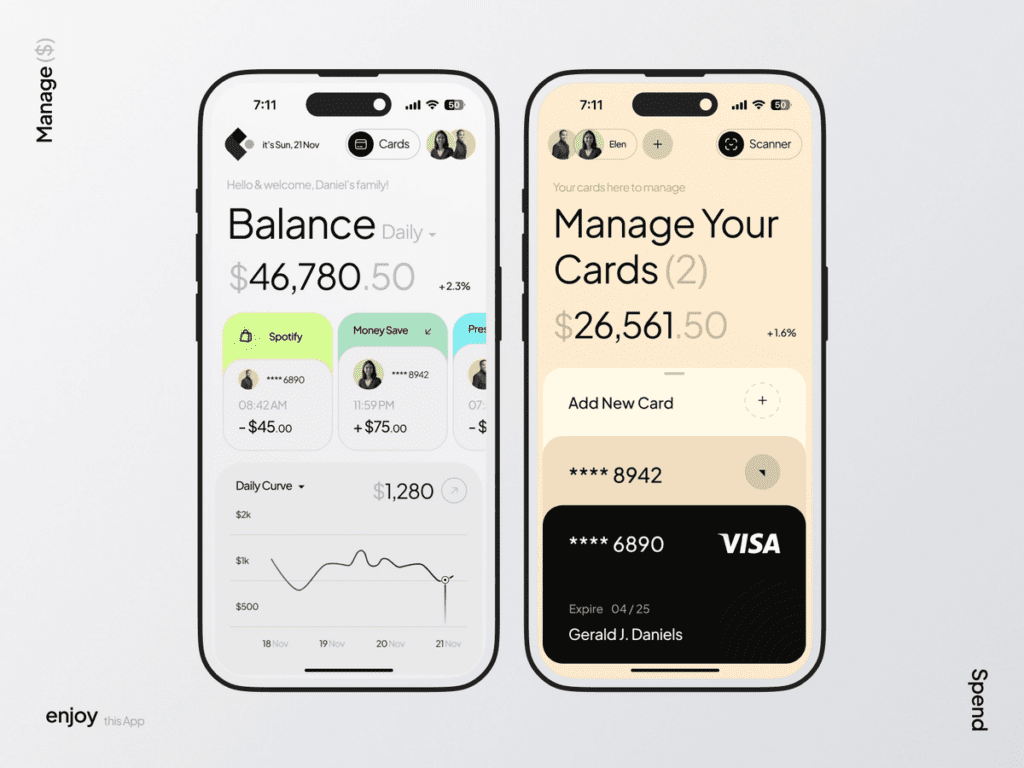

From personal budgets to large corporations, from accounting to banking apps, the fintech industry is exceptionally diverse in sizes and functionalities of its apps. Apps here are used to manage money effectively and easily. They provide a convenient way for users to track their expenses, manage budgets, pay bills, transfer, invest, and save money. Their ultimate goal is to gain people control over their finances. Here is a UI example of a typical fintech app from Dribbble.

In various fields, from personal finance to investing, they help make intelligent decisions, changing the life for better, and reach resource-related goals. You can build an app for people or corporations, for various purposes, but their essential aims will be the same.

Types

The reason is that money is used everywhere. It can be safely stated that they are the basis of our world. So, finance apps are the instruments that maintain and power it. There is an extreme variety of their types and combinations, and you can explore the most essential ones in the list below.

Seven types of such apps are:

- Budgeting apps are mostly used for project management but can be utilized for personal use too. Customers can create budgets, monitor their goals, and track their spending to ensure that they fit into the plan.

- Investment apps provide an interface with necessary data to buy and sell stocks, bonds, and other financial instruments, as well as invest in different companies. They often include portfolio management tools and a database of investment tips.

- Personal finance management apps are similar to budget planners but have a slightly different purposes. They show an overview of your customer’s financial situation by aggregating data from different financial accounts or enabling customers to add them manually. Basically, it is an income/expense tracker.

- Payment apps enable users to send and receive money, pay bills, and make purchases via mobile devices. They can provide digital wallets, use connected bank cards for these purposes, or even issue their own cards.

- Credit and debt management apps work with all loans, tracking them and calculating the customer’s trustworthiness. They include bank credits, student loans, personal debts, and mortgages. Such tracking helps customers pay them successfully and plan money more wisely.

- Tax preparation apps These apps assist users in filing their tax returns, providing helpful tips and suggestions.

- Savings apps, allowing users manage their saves for the future, and plan for retirement and pension. They are often similar to investing and personal finance apps but aim at long-term financial planning.

Examples

Let’s see a bunch of fintech apps with a brief analysis of their features, goals, and missions. All mentioned app types are present in the table below.

How to develop

At first, you need to clearly formulate your app’s aim, mission, and development goals. Research the industry and the market segment of your choice. Decide whether you’ll earn money with your app and how it will be monetized.

Then, the development process will be similar to all other apps: prototype, design, develop, release, and maintain. Let’s review each step.

The finance app development process consists of several steps:

- Planning and determining the app’s purpose and target audience. After that, your team needs to draw the app’s scheme and prototype, showing its functionality and proving why each part is necessary.

- Research includes diving into the fintech market segment to deeply explore its trends, challenges, and potential opportunities. All of that should be carefully gathered.

- Prototyping: combining the data from the first two steps, create a minimum prototype which will be the basis for further development.

- Design the user interface, color scheme, and interactions, which will provide all app’s features to customers and solve their problems.

- Development includes coding for the implementation of these features.

- Test, release, and maintain. Make sure that the app is free of bugs and that users can connect with you for any purpose.

Costs and time

Now we can estimate the budget and development time for your finance app. As you’ve seen, these apps are very different, so the price will vary as well. Depending on the app’s complexity and the developer team you’ll choose, it can range from $10,000 to more than $100,000.

For a simple expenses tracking app, with minimum features, the development cost can be no more than $20,000. For a full stock trading app, with various options and sound UI, it will be no less than $70,000.

You should define your budget at the first two stages of development, After creating an app’s draft, it will be much easier, as you’ll see clearly why you need these money.

Useful and creative features

As you’ve seen, there is plenty of fintech apps present in all market segments. To make your own product exciting and useful, there is a bunch of interesting options to empower your finance app.

- Chatbot will be a good friend for your customer, answering their question and helping them.

- Other AI features will provide insights and recommendations based on user data, analyzing and proceeding with them. Nowadays, your apps are better to be smart.

- Blockchain technology is another trending approach based on intelligent contracts. It will make your app much more secure, especially if you plan to add money transactions or investment features.

- A digital purse with related options of fund transfer and conversion will open many possibilities to send and receive money. Remember that this option requires strong security solutions and compliance with financial laws.

- Gamification is a current trend in app development. Provide customers with interactive interfaces for goal setting and tracking their progress, adding a system of levels and rewards.

- Biometrics to allow customers to access the app using their fingers or face.

- Bill reminders will make your customers grateful many times.

- Saving goals will motivate users to master their money.

- Credit score features will make your customer much more aware of their trustworthiness and show ways of improving it.

Conclusion

Fintech industry is a large and quite competitive one, but you can enter it by implementing creative features, an excellent UI, and cutting-edge technologies. Your app can help people become wealthier, more financially aware, and more satisfied. For reaching that, explore the market and understand which necessary financial products are absent here – and jump into this gap. The success chances will significantly improve, but you need to calculate all possible expenses, as finance apps are very different in complexity and price.