DeFi is revolutionizing the financial industry and creating new possibilities for asset management. The total value locked in decentralized finance stood at its highest in October 2021. At the time, the TVL equated to over $248K billion. In 2022, the numbers look less impressive, yet the resilient popularity of decentralized finance holds firm.

In this guide, we’re going to discuss DeFi services that are changing the way we work with money. The article covers the main characteristics of DeFi services and what to consider when developing DeFi with its unique functionality.

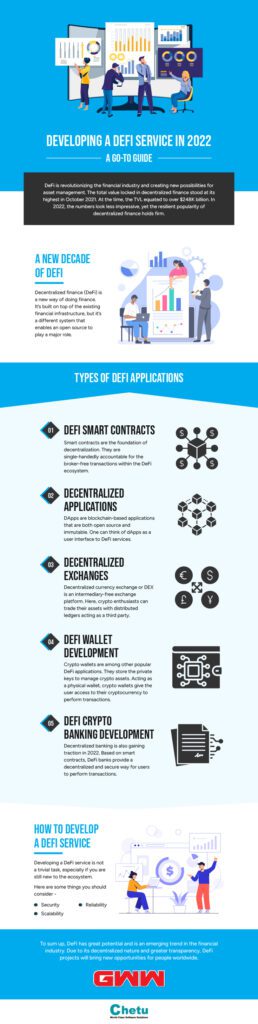

A new decade of DeFi

Decentralized finance (DeFi) is a new way of doing finance. It’s built on top of the existing financial infrastructure, but it’s a different system that enables an open source to play a major role.

It’s not just about using the blockchain or other technologies for payments, settlement, and clearing. DeFi gives all participants in the market (individuals and institutions) access to data streams to use with their funds as they see fit.

The impact of DeFi on the financial world includes:

- DeFi is a new trend in the financial industry that promotes user enablement and data security.

- It’s a new, decentralized way to transfer and store values with no middle-man or centralized unity.

- It’s also a new way to trade cryptocurrencies via interoperable decentralized applications.

- And it can be used as an infrastructure for creating financial products like loans and tokens, especially when combined with other technologies such as smart contracts and stable coins.

Types of DeFi applications

The decentralized landscape abounds in innovative applications and services. The latter catches the fancy of both individuals and business owners. Let’s have a close look at DeFi applications that rock the boat in 2022.

DeFi smart contracts

Smart contracts are the foundation of decentralization. They are single-handedly accountable for the broker-free transactions within the DeFi ecosystem. As such, smart contracts execute automatically once the predetermined agreements are made.

The terms and conditions of this agreement are always embedded directly into the code. Therefore, smart contracts act as a controlling entity with no centralization. Ethereum is the go-to option for smart contract development since it’s the native platform for them.

Decentralized applications

DApps are blockchain-based applications that are both open source and immutable. One can think of dApps as a user interface to DeFi services. DApps are based on smart contracts, while their front end is similar to traditional applications.

Unlike traditional apps, decentralized applications are open and not necessarily controlled by a single person or organization. Decentralized applications or dApps operate on distributed networks such as the P2P network or blockchain, such as Ethereum.

Decentralized exchanges

Decentralized currency exchange or DEX is an intermediary-free exchange platform. Here, crypto enthusiasts can trade their assets with distributed ledgers acting as a third party. Its decentralized nature allows the exchange to eliminate a single point of failure, thus making transactions secure.

Transparent trading is another differentiator of DEXs where each transaction is recorded directly into the blockchain. UniSwap and PancakeSwap are among the leading decentralized exchanges with almost one million transactions run per day.

DeFi wallet development

Crypto wallets are among other popular DeFi applications. They store the private keys to manage crypto assets. Acting as a physical wallet, crypto wallets give the user access to their cryptocurrency to perform transactions.

Crypto wallets come in different forms and shapes based on their hosting:

- Online cryptocurrency wallets are hosted on websites and give users access from any computer device.

- Mobile cryptocurrency wallets offer the users access to money at any time, provided there’s an Internet connection

- An exchange-based cryptocurrency wallet is placed on the website of a cryptocurrency exchange.

- A software crypto wallet is a program installed on a personal computer. The keys are an encrypted code available to the user of the computer device.

- Hardware wallets are USB-like devices with their software.

DeFi crypto banking development

Decentralized banking is also gaining traction in 2022. Based on smart contracts, DeFi banks provide a decentralized and secure way for users to perform transactions. All transactions are stored on the blockchain, adding confidentiality to the user transaction history.

DeFi banks eliminate the stronghold banks and institutions have on users’ assets and make financial services more accessible to far-flung areas.

How to develop a DeFi service

Developing a DeFi service is not a trivial task, especially if you are still new to the ecosystem.

Here are some things you should consider:

- Security: Many important things need to be taken care of when developing a DeFi service. Since everything runs on top of Ethereum and users’ funds are held by your smart contract, your contracts must have strong security practices in place. You should use well-tested libraries and run unit tests before deploying any contracts or submitting them to a mainnet.

- Scalability: The more traffic your service gets, the bigger load it will put on Ethereum and its network. For your DeFi application to be scalable enough for large amounts of users, it needs sufficient capacity for processing transactions per second (TPS). You can achieve this by running multiple instances of your application or increasing gas price during peak hours so that transactions happen faster than usual.

- Reliability: The reliability aspect depends significantly on whether or not there is enough liquidity available on an exchange where people can easily buy/sell tokens from each other at any given moment without affecting token prices too much since there would always be someone ready to sell them immediately after buying one from someone else who wants sell theirs instead because they think they could get better deals elsewhere such as another exchange with lower fees etc.

The Final Line

To sum up, DeFi has great potential and is an emerging trend in the financial industry. Due to its decentralized nature and greater transparency, DeFi projects will bring new opportunities for people worldwide. As you can see, it is not enough just to have a great idea of the service; you need to know how exactly to make it a reality.