Key Takeaways

- ⅓ of Generation Zers and young Millennials use 3 or more mobile wallets.

- HUMBL mobile pay has peer-to-peer payment services in the finishing stages of development.

- The USA significantly lags behind other countries in mobile wallet adoption.

- HUMBL is ramping up the release of their NFT token engine.

- The global mobile wallet rate is expected to rise 75% by 2025.

- HUMBL has 30K active user accounts since its app has debuted on April 16, 2021.

humbl is Building the house from the ground up

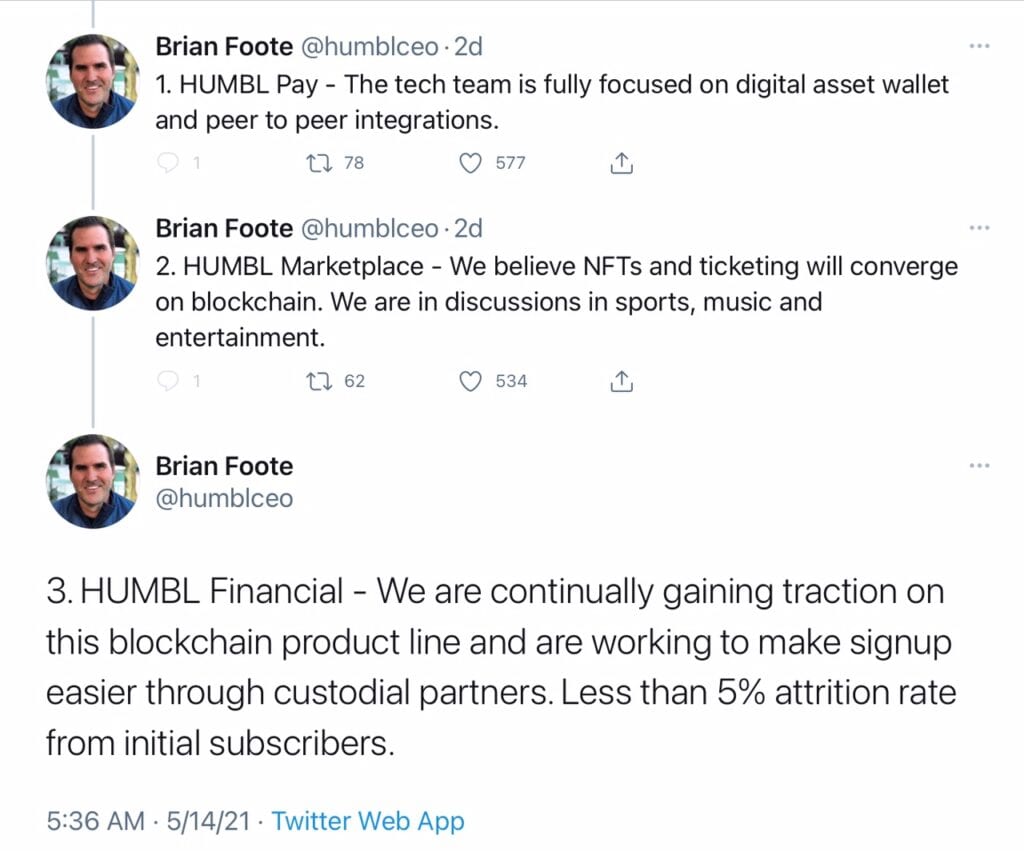

HUMBL mobile pay is gearing up for the next module of deployment. HUMBL isn’t a cryptocurrency but rather a company utilizing the blockchain (network of computers) that crypto coins transact on. HUMBL is immune to the crypto volatility you see in today’s markets. HUMBL mobile pay will be the vehicle to which these transactions will occur. The app is currently in 6 countries for the merchant pay arm of its business. As Brian Foote, CEO of HUMBL notes…more is coming.

Upgrading Mobile Payments in the USA

HUMBL has a slew of countries ready to receive its game-changing application. As I mentioned earlier Phase 2 will include Austria, Belgium, Switzerland, Cyprus, Czech Republic, Germany, Denmark, Estonia, Spain, Finland, France, United Kingdom, Greece, Hungary, Ireland, Italy, Lithuania, Luxembourg, Latvia, Malta, Netherlands, Norway, Poland, Portugal, Romania, Sweden, Slovenia, Slovakia.

That’s a decent guest list for any party. One month ago HUMBL mobile pay opened up USA, Canada, Mexico, Australia, Singapore, and New Zealand. Consider for a second how far behind other countries the USA is lagging when it comes to mobile wallets. What’s the next leg up for HUMBL? Notice the above reference that Foote is putting P2P payments as a top priority. When that is achieved people can finally commit and embrace the canceled culture that we live in.

The global mobile wallet adoption rate is expected to witness an upward trend in the coming years amid an increase in the digital payment market through the usage of mobile payment wallets and contactless payments as an alternative to credit/debit card transactions on a global scale, says Beroe Inc. The mobile wallet adoption rate in 2020, globally, was estimated to be 50-55 percent and is expected to increase to 75 percent by 2025. In the U.S. alone, current mobile wallet adoption levels stood at 22-25 percent.

Mobile Wallet Adoption Rate to Increase to 75 Percent by 2025, Says Beroe Inc

The USA isn’t exactly setting the world on fire when it comes to mobile payments but HUMBL mobile pay is about to change that. A pandemic year essentially moved the goal line 40 yards closer to HUMBL. Considering HUMBL was specifically designed for the 7.2 billion potential users walking on the planet, I think Foote may be selling himself short. If Uncle Elon has his way, Foote will have to consider a Mars branch to his vision of Galaxy credits.

It’s no secret that people are starting to stray away from traditional payment methods and flock towards mobile payments using channels like Apple Wallet and Google Pay. 2020 catapulted digital payments 3 years ahead of its time.

Gary Drenik via Forbes.com

humbl is the One App to Rule them All

A new wave of users is coming. Multiple wallets. Multiple users. Multiple passwords. Have you ever had the privilege of teaching Grammie or Papa how to use their smart TV? How about a smart fridge or phone. Good times right? Now do it for more than 1 app. They are all the same right? Wrong. I’m sure your loved ones with silver hair have a notebook next to their computer with all their passwords and usernames written down. Click here…but not there. Wait this is a different app, you click this one. For example, Peter Lucas’s reported that 2% of young Millennials say they use as many as 9 wallets. Astonishing. Why? Because currently, their choices are limited. One App, One World, One person, One HUMBL. Thankfully in the future, you will only have to teach your grandparents how to use one app.

In addition to the increase in wallet usage among Gen Zers and young Millennials, 32% of mobile-wallet users use three or more wallets as of February, up from 21% in April 2020. Millennials led the way with 27% of senior Millennials and 22% of young Millennials using three wallets. Among older demographics, 22% of Gen Xers use three wallets, compared to 14% of Gen Zers and 10% of Baby Boomers.Overall, 18% of consumers own three mobile wallets as of February, up from 10% in April 2020. Surprisingly, 2% of young Millennials say they use as many as nine wallets.

Peter Lucas

HUMBL update

Update: HUMBL is starting to test their NFT Gallery on Open Sea. As mentioned in HUMBL BEGINNINGS…..RISE OF THE NFT ENGINE, I eagerly await the rollout of their NFT minting process.

HUMBL is a startup technology company. Here is a little excerpt as to how they have grown in their short time.

During the period April 1, 2021, through May 16, 2021, the Company was able to add 7,500 customers to HUMBL Financial, which is estimated to grow the revenues of that segment by $37,425 per month. In addition, the Company launched its mobile application on April 16, 2021, and has amassed over 35,000 downloads with over 30,000 active user accounts that contain a username and password and over 13,000 merchant accounts. Between the growth in revenues by fees generated by HUMBL Financial and through sales of merchandise in HUMBL Marketplace from April 1, 2021, through May 16, 2021, as well as from proceeds received from convertible notes and equity investments, the Company’s current cash position has grown to $4,538,337.

HUMBL’s quarterly report ending March 31 can be found here.

Be different…Be HUMBL.

DISCLOSURES:

I/we are long in Humbl since November 28, 2020. I will continue to accumulate shares until they up-list to NASDAQ. I am not receiving any compensation at the time of writing this opinion from anyone. I am not a financial advisor and please consult a professional before trading any stocks. This is solely an opinion and should be taken as such. I have downloaded the app and I intend to use it regularly.